CRS is proud to present our 142nd Annual Membership Assembly, which is happening as two separate conferences!

In celebration of our global solidarity and past work building Beloved Community, gather with us for our virtual assembly on October 20. To call for peace in the Middle East, join our in-person sojourn to Jerusalem, Palestine, from November 17-21 in partnership with the Sabeel Ecumenical Liberation Theology Center.

Community Renewal Society (CRS) continues to celebrate the life and legacy of the late Rev. Dr. Calvin Morris, a past CRS Executive Director. We are grateful to those who gathered in community with us on April 20 to honor Rev. Morris’ leadership, service, and civil and human rights activism and to those who joined us at his celebration of life in Chicago in March 2024.

To carry out Rev. Morris’ commitment to education and community service, CRS aims to support the Morris Family Memorial Scholarship. Please consider making a gift toward this scholarship. Contributions will offer financial assistance to deserving students.

Community Renewal Society is a faith-based, community organizing and public policy organization that works with congregations in and around Chicago to address issues of racism and poverty.

-

Increase police accountability in Chicago through citywide coalition, constituency and capacity building, by ensuring civilian control of the Chicago Police Department and implementing the Federal Consent Decree.

-

Increase employment, housing and educational opportunities for directly impacted people within jail or the prison industrial complex by advancing legislative reforms that restore rights and create economic opportunities for people with records.

-

Advocate for reparations and economic justice as restitution for moral injury, protracted trauma and cultural disinheritance.

-

Increase shared vision of The Beloved Community, commitment to justice, equity, inclusion, healing and advocacy in solidarity with LGBTQIA+ communities.

-

Community Renewal Society is engaged in racial healing through our commitment to honor the full humanity of individuals impacted by the prison industrial complex, persons displaced and homeless, and by honoring the narratives of those lives stolen by racialized violence, discrimination and police brutality. We are committed to building bridges and providing resources to facilitate healing in diverse capacities.

2022-2023 Platform For Renewal

The Platform for Renewal encompasses five key issue areas reflecting on extensive listening sessions, detailed policy analysis and our commitment together with our member congregations and coalition partners, to do the work of antiracism and justice.

Read About Our Work

CRS shares a powerful message from Zoughbi Zoughbi, President of the International Fellowship of Reconciliation (IFOR), concerning the sanctity of life and the ongoing conflict in Israel and Palestine. His words are a reminder of the fundamental value and dignity of every human being.

Ahead of our 2024 AMA in Jerusalem, CRS Executive Director Rev. Dr. Waltrina Middleton met with Rabbi Brant Rosen and Rev. Dr. Paul McAllister for a panel discussion on April 24 hosted by the Sabeel Ecumenical Liberation Theology Center to amplify injustices around the world. Read our summary from the event here.

Join CRS in the immediate call to action to demand a YES vote on the recognition of Palestine as a member state of the United Nations. The cause of Palestinian sovereignty and security is a matter of justice and rights, and every one of our voices must be uplifted and heard.

As CRS calls on transparent conversations about the Chicago Police Department’s use of excessive force in relationship to Black, Brown, and Indigenous people of our Beloved city, we share a list of traffic stop resources in partnership with the ACLU of Illinois.

In America, policing has almost become synonymous with Black death. The March 21 killing of Dexter Reed (26) in Chicago is yet another horrific example of the ways in which Black bodies are violently and fatally endangered when they come in contact with law enforcement. They can’t keep killing us. The excessive use of force must stop!

CRS remains in solidarity with Palestinians experiencing genocide, ethnic cleansing, and colonialism committed by the Israeli occupation. We urge you to get involved in a new call to action advocating against apartheid and violence in Gaza and demanding a boycott of the 2024 Eurovision Song Contest. Learn more here.

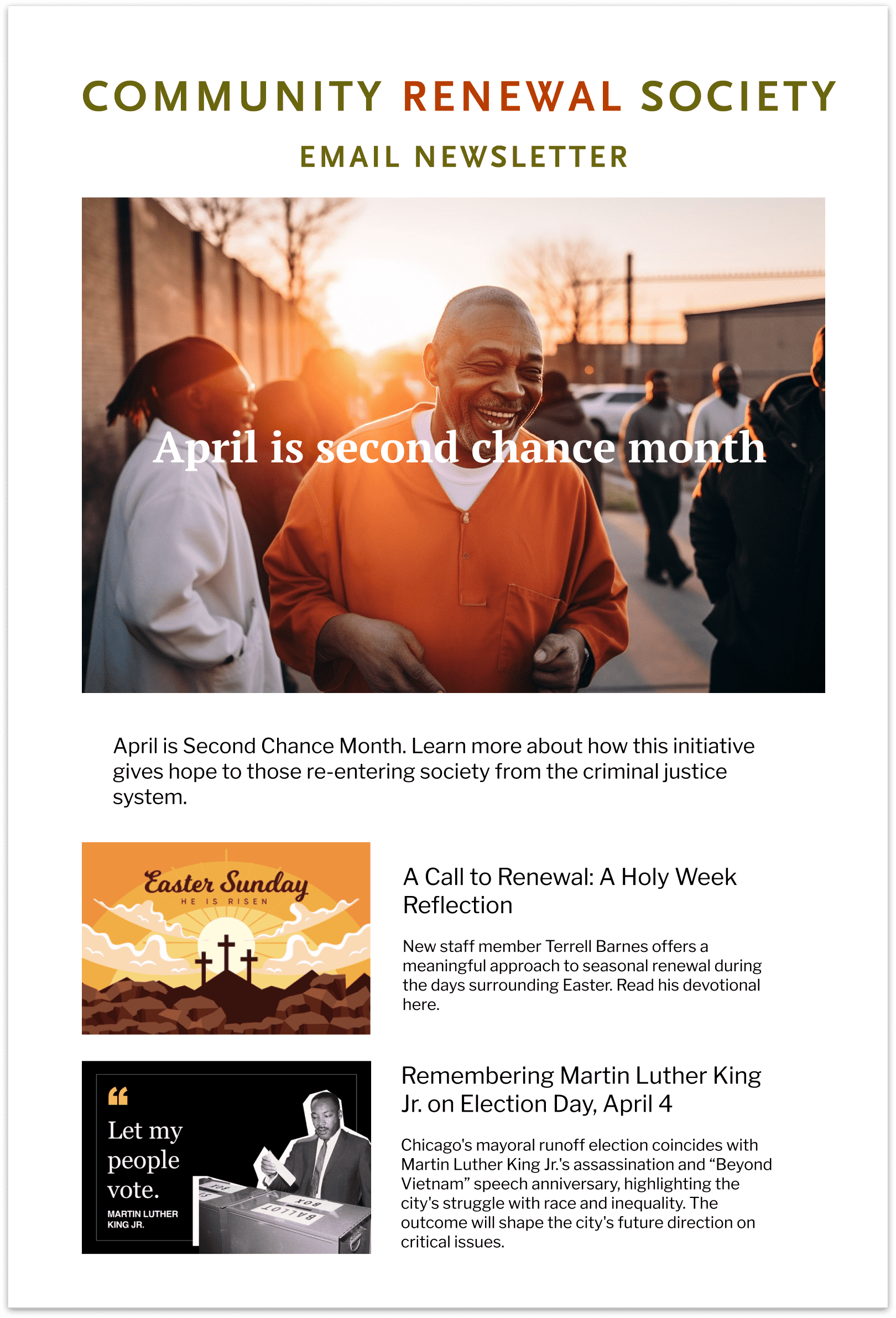

As April ushers in the change of spring, CRS proudly joins the nation in acknowledging Second Chance Month! This designation holds profound significance for us as we champion just reentry and equitable opportunities for all.

An ID program for migrants was held on March 29, stemming from an initiative to provide Chicago residents with a universally accepted government-issued identification, and serving as a reminder of the transformative power of inclusive policies and the enduring spirit of unity that defines the city’s identity.

Fair Housing Month is observed annually in April to commemorate the passing of the Fair Housing Act in 1968, which prohibits discrimination in housing. CRS fights for fair and equitable housing opportunities through advocacy, education, and resources. Discrimination and inequality still exist in housing, and the fight for fair housing continues.

We are reminded of the profound message of hope and healing that lies at the heart of this sacred season, including observations of Ramadan, Passover and Easter — each respectively steeped in Abrahamic traditions. It is a time when we reflect upon the ultimate act of love and redemption — the resurrection of Jesus Christ.

While CRS continues to grieve Rev. Dr. Gay L. Byron’s passing in December 2023, we admire her leadership and celebrate her groundbreaking scholarship, ministry and teaching. Join us in honoring Rev. Byron and keeping her family and friends in our prayers.

CRS shares our deep condolences with the saddening news of another senseless act of cruelty, the unimaginable brutality that stole the life of 11-year-old Jayden Perkins. We extend our heavy hearts to those grieving alongside us.

During an evening worship session of the 2024 Samuel DeWitt Proctor Conference, CRS Executive Director Rev. Dr. Waltrina Middleton provided a moving testimony and call to action. She preached the urgency of uplifting disinvested and displaced communities, not only in Chicago, but in Palestine.

On February 15, CRS gathered at the Chicago City Hall to demand City Council members vote ‘no’ to arbitration behind closed doors for police misconduct cases and vote ‘yes’ for a ceasefire in Gaza.

CRS was honored to be a premier co-sponsor of the 2024 Samuel DeWitt Proctor Conference from February 19-22 at Palmer House Hilton in the heart of Chicago! Read our event recap here.

CRS held an exclusive conversation and book signing featuring our esteemed former Executive Directors, Rev. Dr. Yvonne V. Delk and Rev. Dr. Curtiss Paul DeYoung, two influential figures!

Weather-related disasters are becoming more frequent with the advent of extreme weather cycles. This blog article written by Nina Sumner explores how these events impact people from minority ethnic backgrounds to a disproportionate level.

Read this recap to learn about our 2024 MLK Assembly speakers’ memorable messages connecting current social justice issues to the wisdom and work of Dr. King.

Access the recording of our 2024 Annual Martin Luther King Jr. Faith in Action Assembly from January 15 and check out the bios for our assembly’s speakers.

CRS met with Rev. Bobbie McKay to learn about her faith journey and work with the church over the decades as she navigated hurdles related to her gender. Enjoy a summary of our interview in this blog article.

Find articles recapping how the end of money bail began in courtrooms across communities, moving us toward racial, economic and social justice.

Check out our list of quotes for National Human Rights Month, each echoing the importance of human rights and how we can achieve a more just world together.

Holidays can be hard for many LGBTQIA+ people, especially Thanksgiving, but Friendsgiving can be a lifeline.

Amidst these challenging times and with the holiday season upon us, our unwavering commitment to police accountability holds strong. In respect to the adversities surrounding us, we take pride in the significant strides made in our pursuit of justice reform.

Read staff reflections below of CRS’ powerful fall programming and enjoy photos and recordings! We thank our partners and all those who took part in the 2023 Illinois Conference United Church of Christ Annual Celebration, the A Gathering of Communities conference and our 141st Annual Membership Assembly.

CRS opposes the 2023 Anti-Homosexuality Act passed in Uganda that criminalizes homosexuality and restricts the liberties of privacy and expression for LGBTQIA+ individuals.

CRS announces Sis. Fasika Y. Alem, Programs Director at the United African Organization, as a speaker for our virtual 2023 Annual Membership Assembly. Learn about her here.

CRS announces Rev. Craig B. Mousin, Associate Pastor for Immigrant Justice at Wellington United Church of Christ, as a speaker for our virtual 2023 Annual Membership Assembly. Learn about him here.

CRS announces Rev. Dr. Beth Brown, Pastor at Lincoln Park Presbyterian Church, as the keynote address speaker for our virtual 2023 Annual Membership Assembly. Learn about her here.

Subscribe to our email newsletter

Become a part of Community Renewal Society's pursuit of social justice, empowering you with resources, insights and opportunities to challenge systemic injustices and help build equitable, inclusive communities together!

Take Action

Join CRS' mission for positive change by visiting our "Take Action" page. Become a District Council Member, sign the Reparations Pledge and support crucial legislation. Access resources to find officials, understand legislation and request speakers. Engage in advocacy, faith-based discussions and civic activities like voter registration and letter-writing. Share your thoughts with The Chicago Reporter, connect with CRS on social media and subscribe to our newsletter. Donate to support our work and make a difference today!

Resources

For anyone in the healthcare field or preparing as a student to work with diverse populations, including gender non-conforming youth, check out this article for research information, helpful websites, links to organizations, and even legal and healthcare resources.

We continue to call for greater transparency and insist on honoring the sanctity of life. We uplift the following op-ed by our partner and counsel of ACLU, Attorney Alexandra Block.

Join CRS in the immediate call to action to demand a YES vote on the recognition of Palestine as a member state of the United Nations. The cause of Palestinian sovereignty and security is a matter of justice and rights, and every one of our voices must be uplifted and heard.

The City of Chicago Office of Inspector General (OIG) published its first Quarterly Report of 2024. The report documents sustained investigations into serious misconduct–including lying to OIG, a mishandled sexual assault investigation, threats by a City employee, and false police reports. Read the full report here.

As CRS calls on transparent conversations about the Chicago Police Department’s use of excessive force in relationship to Black, Brown, and Indigenous people of our Beloved city, we share a list of traffic stop resources in partnership with the ACLU of Illinois.

CRS remains in solidarity with Palestinians experiencing genocide, ethnic cleansing, and colonialism committed by the Israeli occupation. We urge you to get involved in a new call to action advocating against apartheid and violence in Gaza and demanding a boycott of the 2024 Eurovision Song Contest. Learn more here.

Many grants are created specifically for LGBTQ+ people with mental health and substance use disorders. In this article, find information on LGBTQ+ addiction and mental health treatment grants for you or a loved one.

In the rapidly changing world, it is essential to create inclusive learning environments that cater to the needs of all learners. One approach that has gained significant recognition is Universal Design for Learning (UDL). Check out this article to understand UDL and its core principles.

Haiti has descended into a critical state of violence and chaos. More than one million children are living in areas under the influence of armed groups.

This article includes an extensive roster of more than 450 Black-owned businesses spanning various sectors that you can support.

In this article, vpnMentor has compiled all of the most important safety information you need to know as you show your solidarity for BLM on the internet.

Weather-related disasters are becoming more frequent with the advent of extreme weather cycles. This blog article written by Nina Sumner explores how these events impact people from minority ethnic backgrounds to a disproportionate level.

Read this blog article to access resources for Palestine toward liberation and healing.

Seniors and others who receive Social Security can indeed qualify for food stamps. Check out this guide to learn how food stamps work.

This is a guide on a Medicare Grocery Benefit, also known as a Medicare Food Allowance or Heath Foods Card, which is available through select Medicare Special Needs Plans.

There are several ways that professionals help people overcome the cycle of addiction. With the right comprehensive treatment approach and continual care, a person can stay in recovery.

This resource on Pretrial Fairness provides guidelines to help attorneys and their clients navigate these changes to the legal system.

The US Campaign for Palestinian Rights provides resources for learning about the most urgent issues affecting the Palestinian people, and for organizing in your local community to support Palestinian rights.

The Office of Refugee Resettlement, An Office of the Administration for Children & Families, provides resources for aiding refugees from Ukraine.

This article discusses Economic Activism for the American Friends Service Committee (AFSC) announcement of the public launch of the Apartheid-Free campaign.

Illinois Department of Human Services provides a resource page for incoming immigrants and refugees.

TJLP is a group of radical activists, social workers, and organizers who provide support, advocacy, and free, holistic criminal legal services to poor and street-based transgender people in Illinois.

May is full of observances! Check out the entire list here and take action with CRS by engaging with our Facebook and Instagram posts that acknowledge these special designations.

Join the Community Commission for Public Safety and Accountability at their public meeting to help us hold the Commission accountable for civilian oversight of the Chicago Police Department.

Join the Community Commission for Public Safety and Accountability at their public meeting to help us hold the Commission accountable for civilian oversight of the Chicago Police Department.

Join the Community Commission for Public Safety and Accountability at their public meeting to help us hold the Commission accountable for civilian oversight of the Chicago Police Department.

Join the Community Commission for Public Safety and Accountability at their public meeting to help us hold the Commission accountable for civilian oversight of the Chicago Police Department.

Join the Community Commission for Public Safety and Accountability at their public meeting to help us hold the Commission accountable for civilian oversight of the Chicago Police Department.

Join the Community Commission for Public Safety and Accountability at their public meeting to help us hold the Commission accountable for civilian oversight of the Chicago Police Department.

Join the Community Commission for Public Safety and Accountability at their public meeting to help us hold the Commission accountable for civilian oversight of the Chicago Police Department.

Join us for our virtual 142nd Annual Membership Assembly and in-person sojourn to Jerusalem in partnership with Sabeel Ecumenical Liberation Theology Center. Please save the dates and fill out our interest form and registration form. More details to come.

Join the Community Commission for Public Safety and Accountability at their public meeting to help us hold the Commission accountable for civilian oversight of the Chicago Police Department.

Events

Member Congregations

Owner of Cole Consulting Corp., Founder and Executive Director of Majority, LLC.

CRS Board Chair Project Manager for the Illinois Alliance for Reentry & Justice

Associate Pastor of Online Engagement and Community Outreach at Covenant United Church of Christ

Associate Conference Minister of

Chicago Metropolitan Association Ministerial Leadership for Illinois Conference UCC

Assistant Professor of Theological Ethics and Society

Chicago Theological Seminary

Meet the Officers & Staff

The Chicago Reporter was founded in 1972 by John A. McDermott to measure Chicago’s progress toward racial equality as the civil rights era ended. Since its inception, it has been housed at Community Renewal Society.

-

The Reporter serves a critical role in the city and nation by focusing the power of investigative reporting on issues of inequality that rarely receive thorough and regular examination by mainstream media organizations. Our core areas of coverage are criminal justice, affordable housing and economic development, jobs and transportation.

The Reporter’s investigations have had a significant impact on policy and the public discourse in Chicago. In the 1980s, then Mayor Harold Washington cited the Reporter’s work in addressing long standing racial inequalities in the distribution of city services. Almost 25 years later, the Reporter’s investigation of racially disparate home mortgage lending sparked a lawsuit by Illinois Attorney General Lisa Madigan that resulted in an $8.7 billion settlement with Countrywide Financial. And in 2015, the Reporter was the only media organization in the city to acquire a video of a police officer shooting into a car of unarmed African-American teenagers, one of many cases of police-involved shootings leading up the release of a video showing the fatal shooting of 17-year-old Laquan McDonald.

Haiti has descended into a critical state of violence and chaos. More than one million children are living in areas under the influence of armed groups.